Driving Impact through Investments

Our Impact

As an early stage, sector agnostic VC focusing on Southeast Asia and India, our investment thesis is anchored around the massive growth potential of the digital economy in the SE Asia and India region, driven by the rise of the consumer class, the acceleration of access to tech-enabled digital financial services, the digitalization of small businesses, and the continuous improvement of infrastructure to support these trends. We back startups that we strongly believe in - regardless of theme, industry or gender of the founders - and help them on their way to becoming regional or global champions.

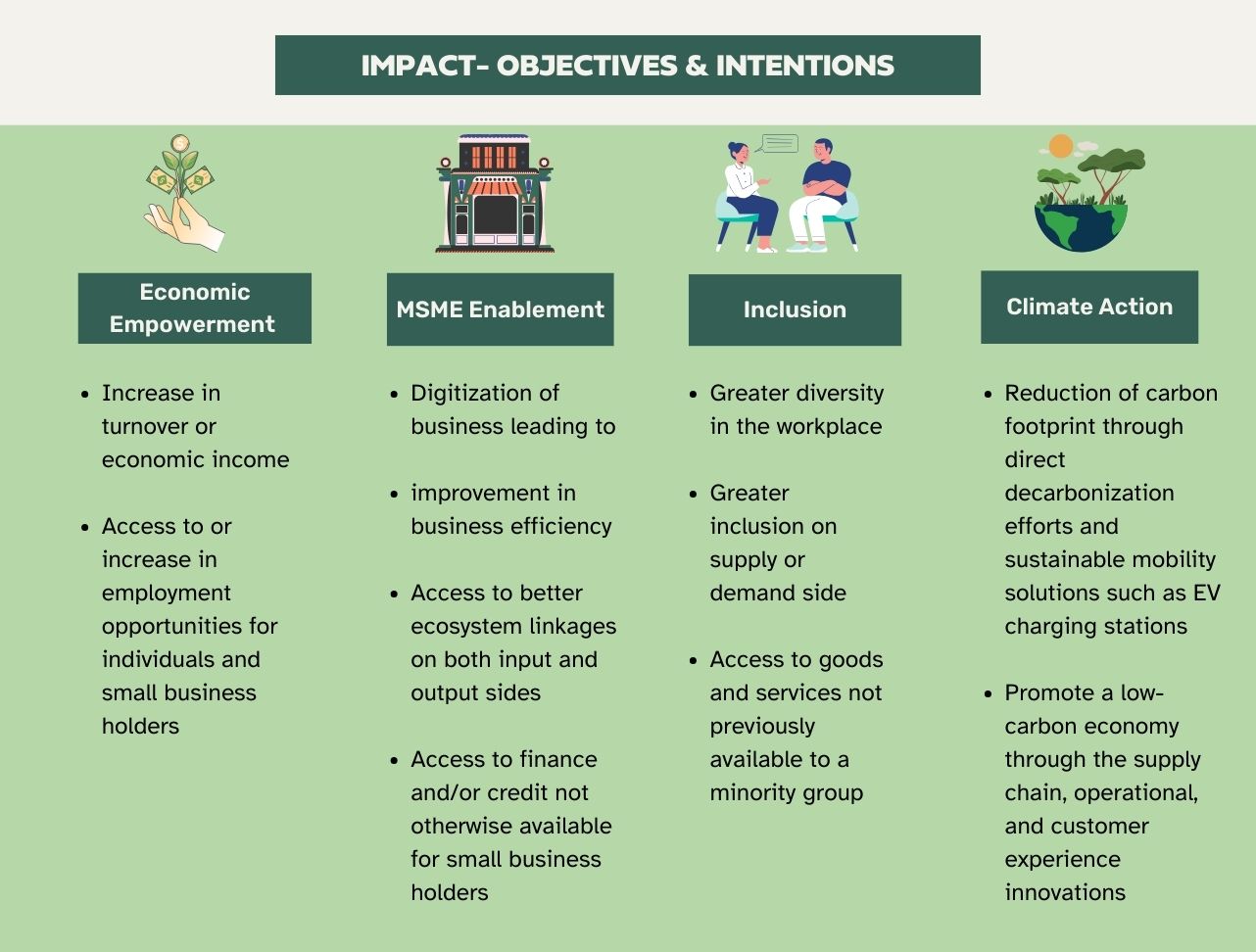

Rooted in the region with deep emerging market characteristics, many of our portfolio companies are well positioned to bring about significant impact to their stakeholders as they grow, particularly in accelerating economic empowerment, MSME enablement, promoting inclusiveness and contributing towards climate action across the region.

Our fund has established ESG integration for risk for several years. Our impact framework represents our efforts to go beyond ESG risk assessment structure and measure the contributions from our portfolios towards our impact goals.

Collectively, our portfolio companies have engendered the creation of over 52,000 jobs since our initial investments. Moreover, they have extended their reach to over 19 million micro, small, and medium enterprises (MSMEs) cumulatively, yielding a substantial US$219 million in revenue for these MSMEs in 2024. Furthermore, several of our ventures are actively contributing towards waste reduction and collectively avoided or reduced close to 470,000 tons of carbon emissions last year.

These numbers not only go to show that businesses truly can truly be a driving force for positive change, but also speak to the roles of VCs to catalyze such change. We are extremely gratified with the accomplishments of our portfolio companies and will continue seeking ways to improve our impact practices moving forward.

How we drive Impact as a Mainstream Investor

View the transcript here.

Notes: (1) All figures are cumulative, and includes impact from divested companies until the point of divestment / in activity unless otherwise stated (2) Includes direct employment (full time and fixed term contract employees), indirect employment (job opportunities indirectly created by the portfolio companies’ customers), and gig workers empowered by portfolio companies (3) Developing markets refer to African nations, Argentina, Bangladesh, Brazil, India, Malaysia, Mexico, Nepal, Pakistan, Philippines, Sri Lanka, Thailand and Vietnam (4) MSMEs include smallholder farmers and fishermen, solo and micro-entrepreneurs, smallholder businesses and individual creators (5) % of female full time and fixed term contract employees as of 31 Dec 2024 (6) Includes direct workforce employed by portfolio companies and creators empowered by relevant portcos in 2024 (7) Includes food waste upcycled or recycled, amount of excess inventory re-commerced and amount of plastic packaging avoided by switching to sustainable alternatives

Vertex Ventures SEA & India Newsletter

Stay updated via Our Newsletter