How Kissht backer Vertex Ventures’ India fintech portfolio is shaping up

*This article is adapted from Vccircle

Earlier this month, venture capital firm Vertex Ventures led online bond investing platform Wint Wealth’s Series B funding round of Rs 250 crore ($27.7 million). The transaction is not only significant for the Indian startup but also highlights how the Singapore-based VC firm has been expanding its exposure to India’s fintech sector.

Vertex, which is backed by Singapore state investment firm Temasek, has been operating in India for more than a decade. It has invested in more than 40 Indian companies and exited about a dozen, including Firstcry, Xpressbees and Yatra.

The VC firm invests across consumer, enterprise technology, health-tech, fintech and other sectors. And while its most well-known bets are on marquee consumer-focused companies such as Licious, Kuku FM, Kapiva and Pilgrim, it has also expanded its India fintech portfolio. Along the way, it has perhaps also taken on greater risk than before. Here’s how.

Vertex didn’t respond to a request for comment for this article. But Vertex partner Kanika Mayar had told VCCircle in an interview last year that the firm was “excited” about fintech–both consumer-facing and financial infrastructure—along with consumer brands, and enterprise software-as-a-service companies with an AI focus.

Indeed, the VC firm has not only added more fintech companies to its India portfolio in recent years but also invested across different funding rounds and backed companies operating in diverse domains, according to a VCCircle analysis based on publicly available data and the research platform VCCEdge.

Building the portfolio

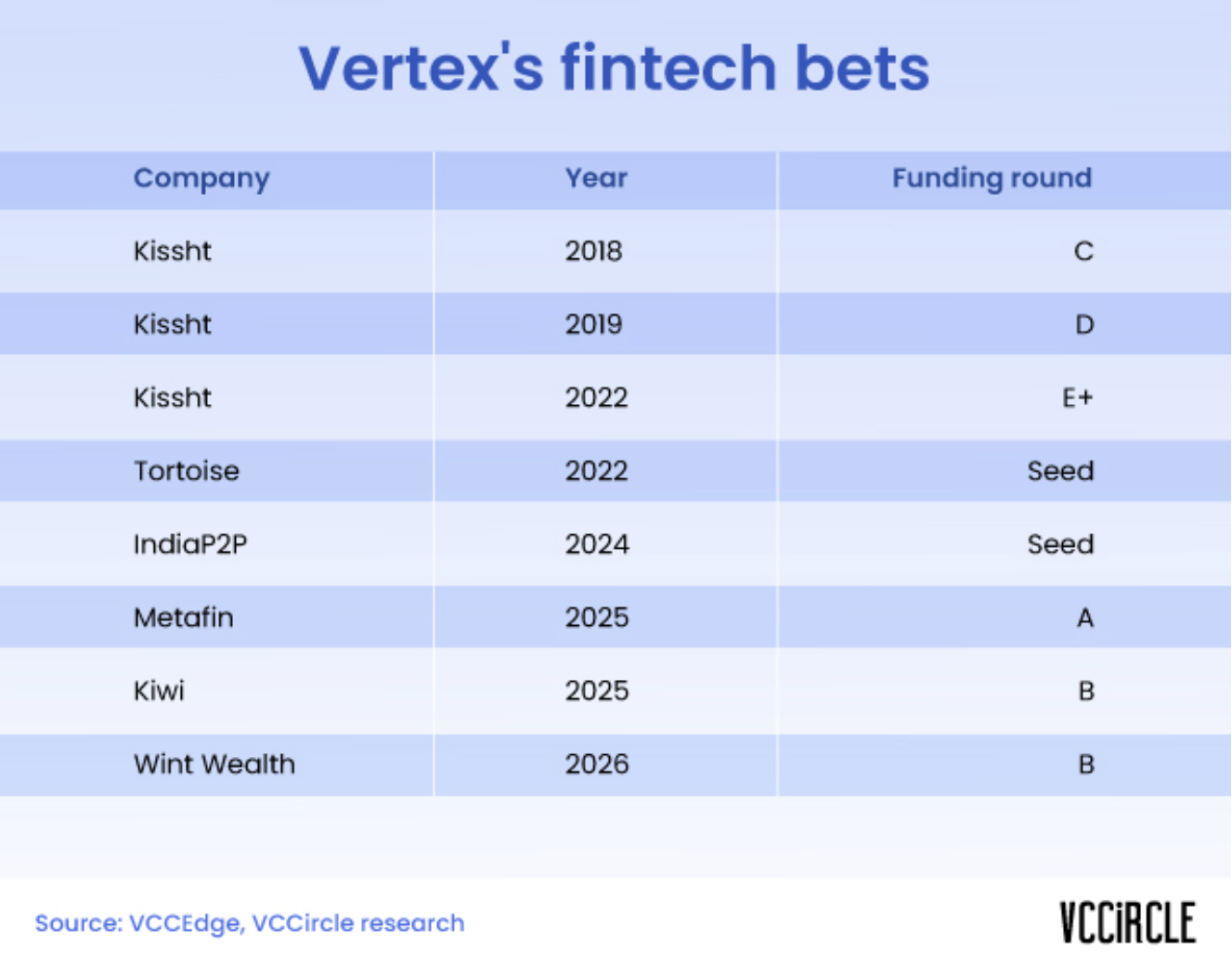

Until 2022, Vertex had only one fintech company in its portfolio. That company was MSME-focused digital lender Kissht. Vertex had first invested in Kissht in 2018 as part of its Series C round and then, via its Vertex Growth arm that makes growth-stage bets, participated in subsequent rounds in 2019 and 2022.

In total, Vertex invested about Rs 320 crore in Kissht, which is operated by OnEMI Technology Solutions Ltd and filed draft documents in August last year to float its initial public offering.

Meanwhile, by 2022, the fintech ecosystem in India had boomed with scores of entrepreneurs building new businesses and dozens of VC firms helping them do so. That year, Vertex made its second fintech bet in India and invested in Tortoise Systems Pvt Ltd. Since then, it has added four companies–IndiaP2P in 2024, Kiwi and Metafin in 2025, and Wint Wealth this year.

Notably, Vertex had backed Kissht in the growth stages–Series C, D and E–by when the company had found its moat and proven its business model. Its other investments, however, have been in seed to Series B rounds. It invested in Tortoise and IndiaP2P’s seed rounds, Metafin’s Series A, and Series B rounds of Kiwi and Wint Wealth. While the investment amount is typically smaller in early stages, these are relatively higher-risk bets.

Notably, Vertex had backed Kissht in the growth stages–Series C, D and E–by when the company had found its moat and proven its business model. Its other investments, however, have been in seed to Series B rounds. It invested in Tortoise and IndiaP2P’s seed rounds, Metafin’s Series A, and Series B rounds of Kiwi and Wint Wealth. While the investment amount is typically smaller in early stages, these are relatively higher-risk bets.

Moreover, Vertex has broadened its horizons and all these companies operate in different domains. Kissht, for instance, is a digital lender that offers loans to SMEs and personal loans. Metafin is a cleantech financing platform that seeks to enable rural India to transition from diesel to solar energy. Kiwi offers virtual credit cards on the Unified Payment Interface (UPI) platform. IndiaP2P is a peer-to-peer lending platform. Tortoise projects itself as a “save now, buy later” fintech platform that lets companies offer device-related benefits to their staff. And Wint Wealth is an online bond platform that lets retail investors invest in corporate bonds.

Still, this diversification doesn’t provide a full picture. For that, let’s take a look at the companies’ financial performance.

Portfolio performance

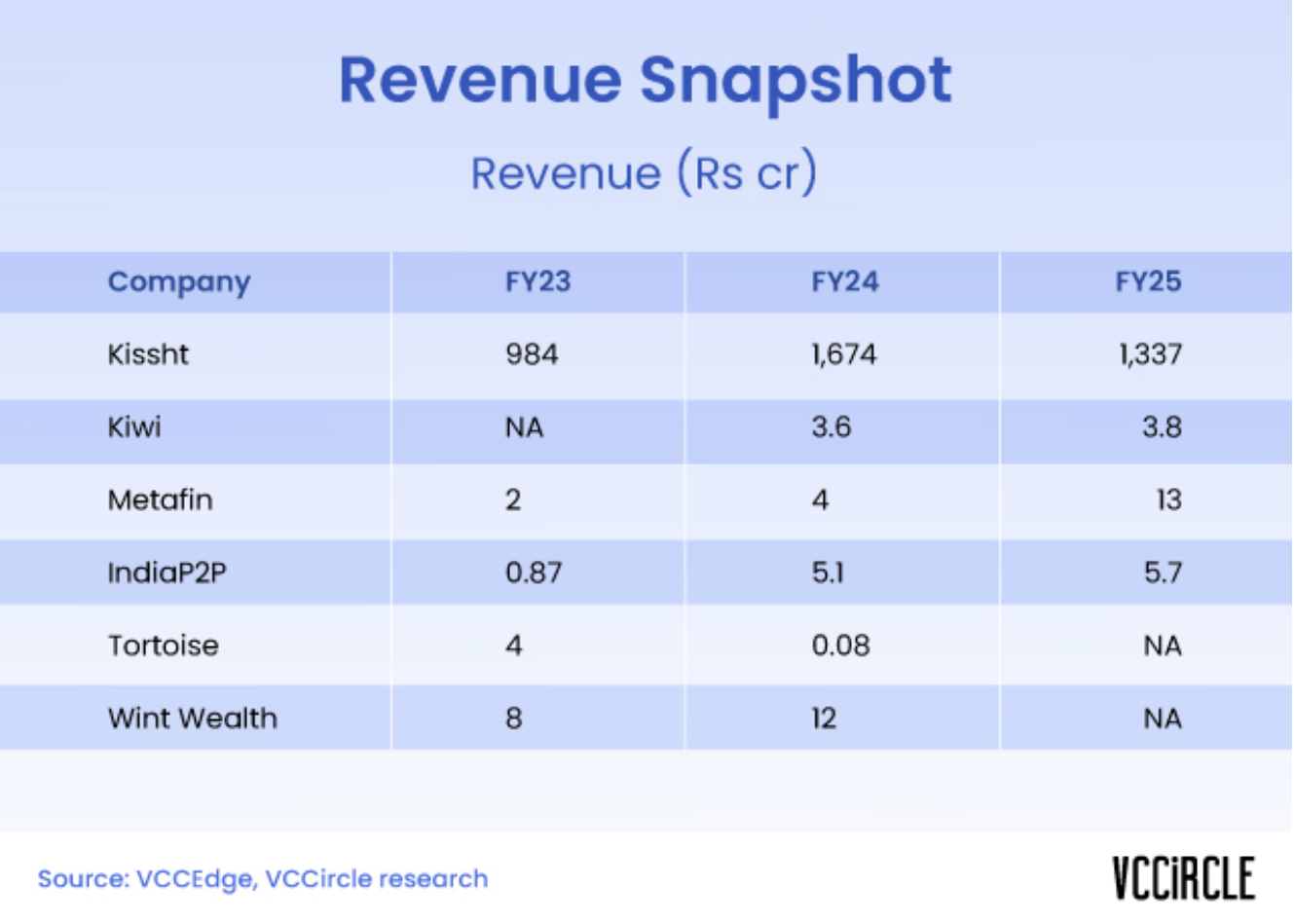

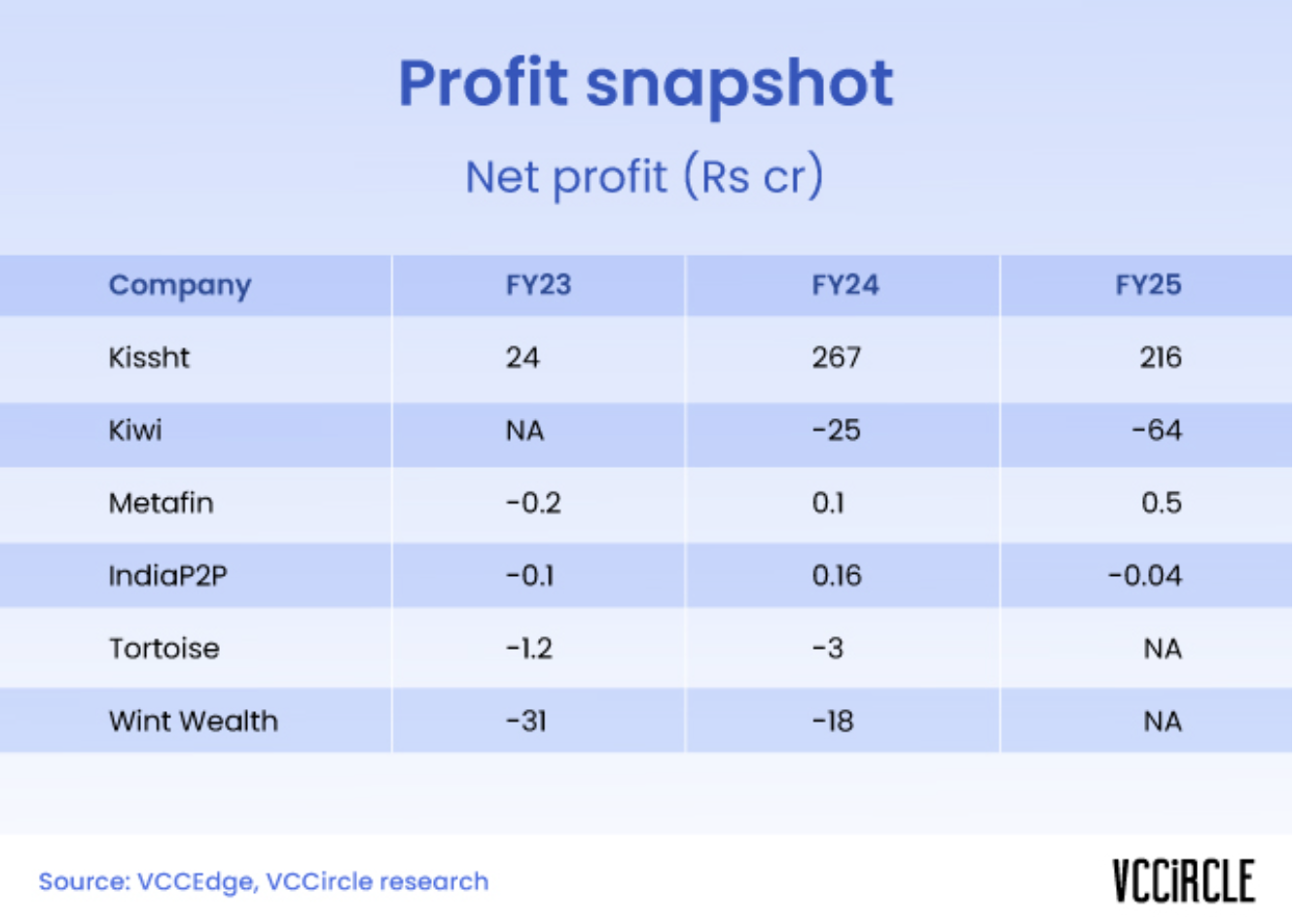

Kissht is by far the biggest fintech company among the lot. During FY19 to FY23, the period when Vertex invested, Kissht’s revenue grew more than 14 times, from Rs 68 crore to Rs 984 crore. Revenue jumped another 70% in FY24 before falling 20% in FY25, per VCCEdge data. Likewise, net profit slipped by over 18% in FY25.

This strong financial performance is perhaps why Vertex, which owns about 23% of Kissht and intends to pare its stake via the planned IPO, is likely to churn out benchmark returns on its bet, VCCircle reported previously.

Among the other fintech companies, Kiwi, Metafin and IndiaP2P had filed their FY25 financials till the time of writing this article but Wint Wealth and Tortoise had not and so these two companies haven’t been covered extensively in this analysis.

Among the other fintech companies, Kiwi, Metafin and IndiaP2P had filed their FY25 financials till the time of writing this article but Wint Wealth and Tortoise had not and so these two companies haven’t been covered extensively in this analysis.

Tortoise seems to be struggling as it recorded a drastic drop in its revenue to just Rs 8 lakh in FY24 from about Rs 4 crore in FY23 – its first fiscal year after its maiden funding round. Its EBITDA slipped further to negative Rs 2.7 crore in FY24 versus negative Rs 1.2 crore. The company hasn’t raised funds after the seed round.

IndiaP2P shifted to an asset light model in FY24 by transferring its eight branch assets to a promoted linked firm, Wealth Grow Technologies. This was aimed at sharpening its focus on its core loan marketplace business, reducing the operational load of running physical branches, and improving financial flexibility by converting fixed costs into variable ones. Wealth Grow now provides infrastructure, loan sourcing, and collection services for a commission to IndiaP2P, and has picked up a 20% stake in the company.

IndiaP2P shifted to an asset light model in FY24 by transferring its eight branch assets to a promoted linked firm, Wealth Grow Technologies. This was aimed at sharpening its focus on its core loan marketplace business, reducing the operational load of running physical branches, and improving financial flexibility by converting fixed costs into variable ones. Wealth Grow now provides infrastructure, loan sourcing, and collection services for a commission to IndiaP2P, and has picked up a 20% stake in the company.

IndiaP2P’s revenue inched higher in FY25 but it slipped into a small loss. Meanwhile, Wealth Grow reported a net loss of over Rs 4.6 crore on topline of Rs 78 lakh for FY25. This indicates that while IndiaP2P’s FY25 loss margin was just 2.8%, this was largely due to its pivot to an asset light model and transferring operations to Wealth Grow, which is absorbing the real burn.

The VCCircle analysis also showed that Kiwi’s revenue inched a little higher in FY25 but its net loss more than doubled. Metafin’s topline tripled in FY25 and profit jumped more than three times.

To be sure, barring Kissht, all other fintech companies in Vertex’s India portfolio are relatively small players and it remains to be seen whether they can stand the test of time.

For the latest news on Vertex Ventures SE Asia and India and our portfolio companies, follow us on Linkedin or subscribe to our monthly newsletter.