Khushbu Topandasani: Indonesia’s Evolving F&B Industry Revisited: Post-pandemic, How will it Evolve?

"Food, glorious food”- a phrase we commonly hear, stands especially true for Asians, given that it forms an integral part of our daily life and culture.

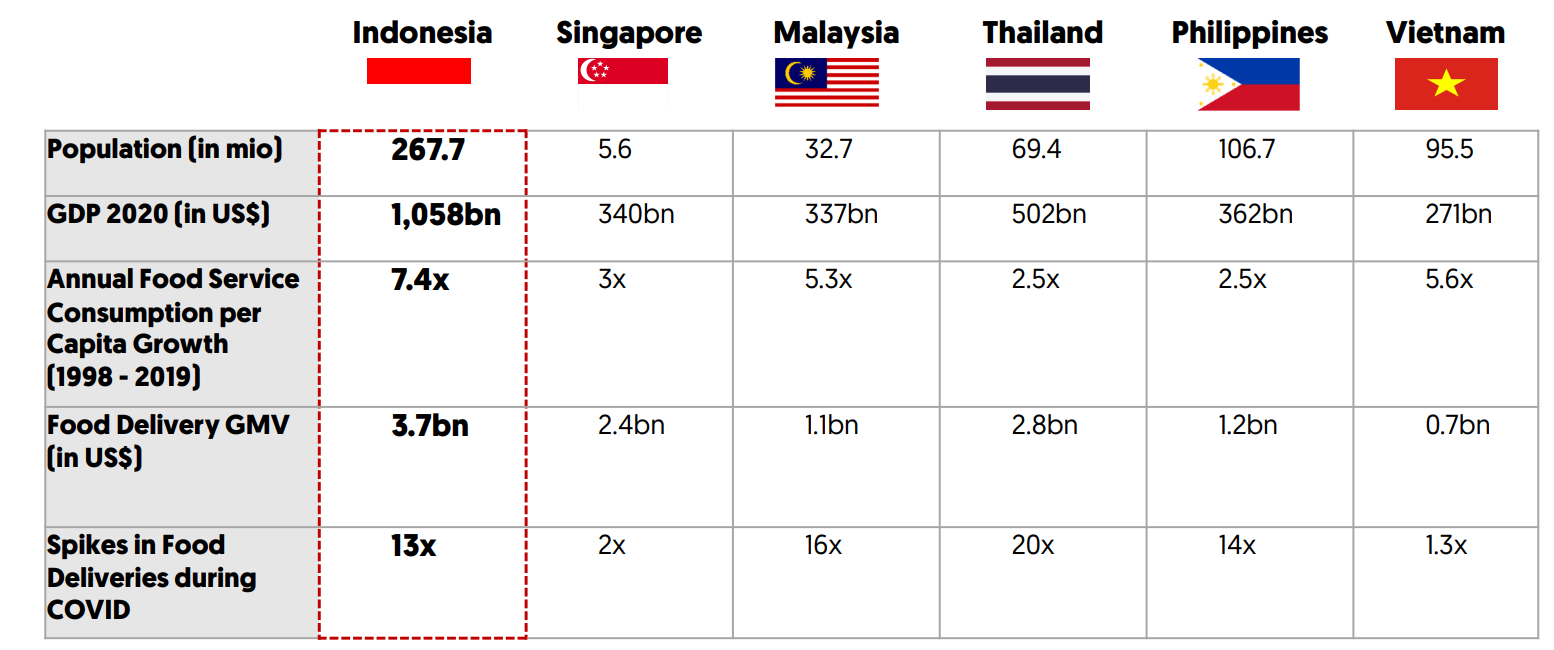

In 2021, we wrote about the “Evolving F&B Industry: Amidst the pandemic…”, expounding on the growth opportunities in Indonesia’s food and beverage (F&B) industry amidst the COVID crisis. We shared that Indonesia’s Total food delivery services saw strong growth in 2021, ~24.3% with gross merchandise value (GMV) increasing to US$4.6 billion, from US$3.7 billion in 2020. The country also represents Southeast Asia’s biggest market for the food delivery sector with an estimated GMV of US$3.7 billion in 2020, followed by Singapore’s US$2.8 billion and Thailand’s US$2.4 billion. To meet growing consumer needs, we saw that F&B merchants have also turned to cloud kitchens to expand footprint to new locations. Cloud kitchens are expected to grow at a CAGR of 20.7% from 2021 to 2028.

Key F&B Market Statistics for Indonesia and other SEA Countries. (Dailybox Group)

Since publishing that article, we have led the Series A investment in Dailybox Group, an Indonesia-based online multi-brand start-up restaurant. Fast forward to today, we are pleased to witness their growth and resilience, navigating the hurdles brought on by Covid-19 and displaying utmost agility at every challenge that came their way. At Vertex Ventures Southeast Asia & India (VVSEAI), we seek to fund and nurture strong founders and innovative start-ups that have the potential to be a regional or global champion.

“Today, we are proud to support Dailybox with a follow-on investment in its series B fundraise, led by the Northstar Group and Vertex Growth fund. We are pleased that Dailybox’s business has been resilient and has grown by more than 100x during the pandemic. We are excited to continue to support and work closely with Kelvin and his team as they expand to other cities and towns in Indonesia and abroad.”

In 2022, we are relieved that the effects of COVID have subsided, with dine-in making a comeback. It is certainly a good time for us to revisit our original piece and share our thoughts on how the F&B industry will evolve in the new normal.

Whether knowingly or unknowingly, many of us have made almost irrevocable changes to our habits and lifestyles in the past two years, in adaptation to the pandemic. For instance, in Indonesia, ordering a meal via Gojek, Grab and new entrants Shopee Food and Traveloka Eats, and having it delivered to a home or office has become embedded into our lifestyle. The proliferation of at-home entertainment also means that consumers usually do “order in” something practical to eat while getting their dose of Netflix with family or friends. Many companies have also embraced the work-from-home concept such that some form of work hybrid work arrangement will persist even as the pandemic abates.

Hence, a pertinent question to answer would be: “What are the key changes to both consumer and merchant behavior post-pandemic in Indonesia’s F&B industry, and what does this mean for the sector’s outlook?”

Post-Covid Diner Dynamics - Dine-in Returns, Delivery Likely Remains Popular

According to a recent Kearney report, Asian consumer preferences for dining out and eating in have witnessed a fundamental change due to the pandemic. A net 28% of consumers surveyed have shifted their preferences from dining out to dining in while (56%) consumers will be dining out more. However, interestingly, this group would not dine-out as often compared to the dominant majority (84%) pre-pandemic. We believe that the reasons include: the ‘sticky’ change in lifestyle to prefer dining at home and streaming entertainment, saving travel time to F&B outlets, as well as hybrid work arrangements (since they are already at home).

The ‘sticky change’ of preference from offline dining to online delivery. (Kearney Analysis)

In Indonesia, we are also seeing the same trend. Pre-pandemic, Indonesians had limited food options on online platforms. When one thinks about food delivery, top of mind brands include McDonalds, Hokben, Bakmi GM or KFC, rather than your ‘friendly neighborhood’ food joints. Today, with a growing number of platforms in the market and new generation brands emerging, consumers are increasingly spoilt for choice, and enjoy the convenience of getting meals in the comfort of their homes or offices, at affordable prices.

In addition, we also observed that with rising affluence, consumers are demanding unique and innovative cuisines. In our previous article, we shared about the modernisation of Indonesian meals and how younger generations (millennials and Gen Z) are more selective and prefers high quality meals with friendly pricing. They are not just looking to order a McDonald’s meal on the food delivery platform, instead, they look for novelty – new dishes that are tantalising to their taste buds. Platforms including Instagram and Tiktok have been instrumental in enabling discovery of new dishes and food joints. In fact, a lot of dishes created by SMEs have gained virality through these platforms and non-sponsored influencer marketing.

Emergence of the Cloud Kitchen Model during the Pandemic

Share of Cloud Kitchen in GMV mix, 2016 - 2021F (Redseer)

The pandemic has encouraged the adoption of cloud kitchens (something we also mentioned in our previous article) in the F&B space. Cloud kitchens can come in different operating models – including the Food Court, the Kitchen Operator and the Hybrid Cloud Kitchen. According to Grand View Research, Indonesia’s cloud kitchen space is estimated to grow at a compound annual growth rate of 20.7% from 2021 to 2028.

“While existing restaurants can use cloud kitchens as a sandbox to test new ideas and concepts before they roll them out, on the other hand, it can help entrepreneurs in building a brand and loyal customer base with substantially low Capex requirements.” (Redseer report)

Major cloud kitchen players in Indonesia such as Grab Kitchen and Yummy have been enablers for brands to expand at low cost. In the endemic world, we foresee that F&B businesses will continue to leverage food delivery platforms and cloud kitchens, given the latter’s favorable unit economics. These businesses also see the benefits of using these platforms to innovate new dishes and test market’s acceptance at low costs.

Omnichannel: A Promising Strategy to Tackle the Post-pandemic F&B Market

It is hard to predict how consumer preferences may change, as we are continuously adapting to changes in regulations and other external factors. There also exist simultaneous trends of retained preference for delivered meals, and returning uptake of in-person dining. Hence, we believe the true winners in the post-pandemic F&B landscape are the ones that effectively serve consumers on both ends with an omnichannel approach, combining both online and offline channels. These can come in the form of many permutations of the following, as channels for:

- Discovery (ads, social media, aggregators)

- Order placement (aggregators, in-house app, in-restaurant self order kiosk, wait staff)

- Consumption (in-restaurant, take-out, delivery)

Omnichannel meets the increasing demand for flexibility by diners, especially in the post-pandemic world. An ideal omnichannel experience removes friction and creates a seamless and consistent experience for consumers.

Why We Invested – Our Dailybox Group Investment Thesis

As we mark Dailyco’s successful Series B fundraise, we also wish to highlight the founders’ resilience, strong problem solving skills and adaptability to the challenges brought about by the pandemic. Dailybox Group revenues have grown over 10x since Jan 2020 proving a robust, sustainable business model despite headwinds.

"Dailybox Group is an example of a start-up that successfully balances growth and profitability. From a single brand with a limited footprint, Dailybox Group has quadrupled its earnings and transformed into a collaborative platform in the midst of the pandemic. They are agile and constantly innovate, paving the way for them to become one of the most resilient key players in the F&B industry. '' said Chua Joo Hock, Managing Partner, VVSEAI.

Dailybox Founder, Kelvin Subowo in his kitchen. Dailybox group recently raised its Series B round of US$24M.

Our conviction behind the company is driven by the following three key areas, in addition to the strong background and execution ability of the leadership team:

- Omnichannel and Multi-brand strategy

- Strong brand partnerships especially with Celebrity Masterchefs - Chef Juna and Chef Renatta

- Proven pilot in Tier 2 and Tier 3 Cities

Robust Omnichannel and Multi-brand Strategy

Dailybox’s highly scalable multi-brand approach and collaborative platform enables them to stay relevant and capture mindshare. Dailybox is actively increasing their lineup of brands either by building in-house, acquiring or collaborating with other small and medium enterprises to attract and delight consumers.

As mentioned above, the younger generations are demanding unique and innovative menus, which is what Dailybox Group brings to the table - a new experience to easily access and taste the finest cuisines curated inhouse under the umbrella of brands they own (Dailybox, Shirato and Breadlife).

We think consumers are likely to continue using food delivery platforms but these habits and preferences may evolve overtime. Dailybox is watching the space closely and with their omnichannel presence, are able to target both online and offline channels via a highly localised approach. Their recent strategic acquisition of Breadlife has enabled them to serve untapped consumer demand with hybrid bundled menus.

Exceptional Food, Strong Brand Partnerships

Dailybox is one of the first multi-brand online restaurant startup companies in Indonesia that partners with known personalities such as Master Chef Juna and Renatta. Chef Juna has curated special dishes such as Ayam Woku and Udang Sambal (fried onion sambal prawn) with Dailybox to wide popular reception whilst Chef Renattas’ Sei Sapi Susu (smoked beef) continue to win hearts.

Udang Sambal (Sambal Prawn) is just one of the many innovative offerings at Dailybox.

“This is the first time I've been invited to collaborate to make a typical Indonesian menu because usually I'm asked to make foreign menus. I feel very challenged because it is not easy to find comfort food typical of the archipelago that everyone will definitely like,” Master Chef Juna said.

We believe that operational excellence, strong marketing and long-term partnership with prominent figures such as Masterchefs and key brand ambassadors will lend well to brand recognition, long term customer satisfaction and brand preference. Furthermore, the mission of bringing various Indonesian cuisines from different provinces (eg, Aceh food, Manado food etc) to the rest of the country is deeply rooted Dailybox’s DNA.

Proven pilot in Indonesia’s Tier 2 and Tier 3 Cities

With increasing internet penetration and consumer demand in the second and third-tier cities, we believe that there is pent up demand for fresh F&B brands from Tier 1 cities to grow and thrive in those markets. With an omni-channel presence in more than 20 cities in Indonesia and over 150 cloud kitchen outlets, Dailybox is a first mover and largest brand operating using the cloud kitchen model in these cities. The new Series B funding will be used for expansion into second and third-tier cities and enhancing Dailybox’s tech capabilities.

“We are glad to continue supporting the team with our breadth and depth of knowledge in the category and networks to help them rise to new heights," said Chua Joo Hock, Managing Partner, VVSEAI.

(This article is first published on medium.)

Edited by Elise Tan

Like this article? Read our 2021 article on “Indonesia’s Evolving F&B Industry: Amidst the pandemic, the F&B industry emerged as one of the most resilient sectors through digitalization” here.

Like what you are reading? Subscribe to our monthly newsletter for more.

**For the latest news on Vertex Ventures SE Asia and India and our portfolio companies, follow us on Linkedin or **subscribe to our monthly newsletter.